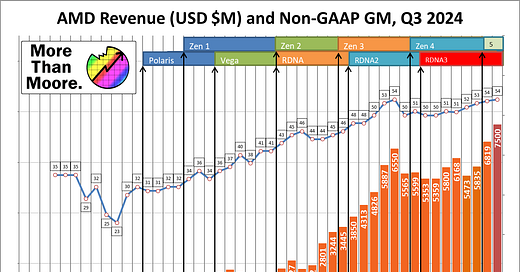

Both with regards to technology and financials, AMD 0.00%↑ has been on a tear for the last several quarters, and their new Q3 numbers has seen that company continue that trend – with no immediate signs of it stopping. Not only are the Q3 numbers the biggest, but it means the datacenter business is now more than half the company, and Q4 numbers are expected to sha…

Substack is the home for great culture